AADirection Capital Corp. and Centenario Gold Announce Update on the Qualifying Transaction

ACCESS Newswire

24 Mar 2023, 00:38 GMT+10

VANCOUVER, BC / ACCESSWIRE / March 23, 2023 / AADirection Capital Corp. (TSXV:AAD.P) ('AADirection'), and Centenario Gold Corp. ('Centenario') are pleased to announce an update on the 'Qualifying Transaction' (announced Feb. 2, 2023) where AADirection is planning to amalgamate with Centenario. The parties have completed a number of steps towards completing the Qualified Transaction.

Pre-Filing Submissions

The parties made comprehensive pre-filing submissions with the Exchange including providing a draft technical report (the 'Technical Report'), draft audited financial statements of Centenario, a comprehensive budget with respect to the use of proceeds with respect to the proposed concurrent subscription receipt ('Subscription Receipt') financing of a minimum $1,750,000 or such higher dollar amount as required by the Exchange (the 'Minimum Dollar Amount'), a comprehensive central securities register of Centenario, the results of due diligence investigations, and related information including personal information forms for all proposed insiders of the resulting issuer ('Resulting Issuer') resulting from the closing of the Qualifying Transaction. The parties also provided the Exchange with a formal loan agreement signed by the parties and a separate security agreement as well as initial filing fees of $10,000.

Based on these submissions, the Exchange approved the secured loan of $150,000 from AADirection to Centenario. The proceeds were used by Centenario to make the property payment on the Eden Property due March 24, 2023 (no other property payments are due until March 24, 2024), and for expenses of the Qualifying Transaction. The loan is secured by way of a general security agreement against the assets of Centenario.

Also based on these submissions, the Exchange indicated that AADirection was a good candidate to receive a waiver of the sponsorship requirement (as otherwise required pursuant to the CPC Policy of the Exchange). No final determination will be made until after the formal application by AADirection for Exchange acceptance of the Qualifying Transaction which is not expected to occur until at least some date in April.

The Exchange has also provided initial minor comments on Centenario's financial statements, and provided comprehensive comments on the Technical Report which are being addressed.

Definitive Agreement

The Definitive Agreement between the parties has now been signed and Sedar filed under AADirection's profile. With this step completed, Centenario's audited financial statements are expected to be finalized and signed off by the auditors next week.

Annual and Special Meeting

Centenario Gold has called a special shareholder meeting for Tuesday April 11, 2023 at 10:00 am to obtain shareholder approval by special resolution ,with respect to the amalgamation of Centenario with AADirection, which includes the offering of dissent rights to shareholders. The meeting will be held at the Centenario offices at 615 - 800 West Pender Street, Vancouver, B.C. The Record date was set at March 15, 2023, and the Notice, Information Circular and Proxy have been mailed to Centenario shareholders and have also been SEDAR filed.

Concurrent Financing

The proposed concurrent Subscription Receipt financing ('Offering') is proceeding smoothly with the final form subscription agreement being circulated to prospective investors and Centenario having received expressions of interest to fill the minimum amount of CAD$1.75 million to close in escrow ('Escrow') in advance of the closing of the Qualifying Transaction.

As a condition of closing of the Offering, such dollar amount as is equal to or greater than the Minimum Dollar Amount (the 'Escrowed Proceeds'), must have been delivered to the escrow agent (the 'Escrow Agent'), to be held in the Escrow Agent's trust bank account (the 'Escrow Account') and not released until the 'Escrow Release Conditions' (as defined below) have been satisfied. On closing of the Offering, the Escrowed Proceeds will be held by the Escrow Agent in the Escrow Account.

Upon delivery by Centenario to the Escrow Agent of a release notice (the 'Release Notice'), the Escrow Agent will release the Escrowed Proceeds to Centenario. The Release Notice will confirm the satisfaction or waiver of the following conditions, among others (collectively, the 'Escrow Release Conditions'):

- approval of the Amalgamation by the shareholders of Centenario by special resolution;

- the conditions precedent in the Definitive Agreement for completion of the Amalgamation and Qualifying Transaction, other than the financing condition (which will be satisfied with the Escrow Release),

- receipt of written conditional acceptance ('Conditional Acceptance') of the Qualifying Transaction by the Exchange and, other than the financing condition, the satisfaction of all material conditions precedent of the Exchange contained in its Conditional Acceptance such that upon the Escrow Release, the Amalgamation of the parties will proceed immediately and all securities of Centenario will be exchanged for securities of AADirection on a 1:1 basis. In order to obtain Conditional Acceptance, the parties are required to submit a comprehensive filing statement that must be in form and content required by the Exchange. The filing statement is at the preparation stage; and

- receipt of any other required regulatory approvals.

Upon satisfaction or waiver of the Escrow Release Conditions, each Subscription Receipt will be automatically converted or exchanged, without further action by the holder of such Subscription Receipt (and for no additional consideration), for one unit (each, a 'Centenario Unit') with each Centenario Unit consisting of one common share of Centenario (each, a 'Common Share') and one-half of one shares purchase warrant (each whole warrant, a 'Warrant'), subject to adjustment in certain events. Each Warrant will entitle the holder to purchase one Common Share at a price of $0.30 for 24 months following the date of issuance of the Warrants. The Amalgamation will then proceed immediately (expected same day as the Escrow Release).

About AADirection Capital Corp.

The AADirection, a capital pool company within the meaning of the policies of the Exchange, was incorporated in British Columbia on December 1, 2020 and was listed on the Exchange on August 17, 2021. The AADirection does not have any operations and has no assets other than cash. The AADirection's business is to identify and evaluate businesses and assets with a view to completing a Qualifying Transaction.

About Centenario

Centenario, through its Subsidiary, holds an option (the 'Option Agreement') on a resource exploration property (the 'Eden Property') which consists of two (2) contiguous and titled mineral concessions named El Eden and El Eden 1 covering approximately 2,489 hectares, which property is located in the Cosala Area of southeastern Sinaloa State and southwestern Durango State, Mexico, in the southwestern foothills of the Sierra Madre Occidental, approximately 160 kilometres north of Mazatlan, Mexico.

The El Eden property is located on the northern boundary of a block of claims (approx. 6,270 hectares), known as Los Reyes, owned and operated by a Vancouver-based company called Prime Mining Corp.

For further information please contact:

NEITHER TSX VENTURE EXCHANGE NOT ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Completion of the Qualifying Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, majority of the minority approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Qualifying Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange has in no way passed on the merits of the proposed transaction and has neither approved or disapproved the contents of this press release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

BUSINESS DISCLOSURE & FORWARD LOOKING INFORMATION

The above information regarding Centenario's business and management has been provided by Centenario, and based on preliminary due diligence reflects the beliefs and expectations of AADirection's management. This press release contains forward-looking statements and information that are based on the beliefs of management and reflect AADirection's current expectations. When used in this press release, such words as 'estimate', 'project', 'belief', 'anticipate', 'intend', 'expect', 'plan', 'predict', 'may' or 'should' and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release includes information relating to the Qualifying Transaction (including shareholder approval, the name change, and completion or termination), the Financing, the controlling shareholder, and the directors and management of the Resulting AADirection upon completion of the Qualifying Transaction.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: risks associated with the completion of the Qualifying Transaction and matters relating thereto and the risks associated with the marketing and sale of securities, the need for additional financing, reliance on key personnel, the potential for conflicts of interest among certain officers or directors with certain other projects, and the volatility of AADirection's common share price and volume. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and AADirection undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

The AADirection cautions that the foregoing list of material factors is not exhaustive. When relying on AADirection's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The AADirection has assumed a certain progression, which may not be realized. It has also assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. While AADirection may elect to, it does not undertake to update this information at any particular time.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS THE EXPECTATIONS OF THE AADIRECTION AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE AADIRECTION MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

SOURCE: AAD Direction Capital Corp.

View source version on accesswire.com:

https://www.accesswire.com/745507/AADirection-Capital-Corp-and-Centenario-Gold-Announce-Update-on-the-Qualifying-Transaction

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of BC Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to BC Post.

More InformationInternational

SectionSources: Meta won’t alter data model, faces fresh EU charges

BRUSSELS, Belgium: Meta is holding firm on its controversial pay-or-consent model, a move that could lead to fresh antitrust charges...

Trump’s tariff push could push US rates above 20%, ICC says

LONDON, U.K.: American consumers and businesses could soon face the highest overall tariff burden in more than a century, according...

U.S. Urged to Investigate After Israeli Settlers Beat Palestinian-American to Death

The family of Sayfollah Saif Musallet, a 20-year-old American citizen who was beaten to death by Israeli settlers in the occupied West...

New Hampshire federal court ruling defies Trump’s citizenship move

CONCORD, New Hampshire: A federal judge in New Hampshire issued a crucial ruling on July 10 against President Donald Trump's executive...

Houthis attack cargo ship in Red Sea, raising maritime safety fears

DUBAI, U.A.E.: A cargo ship flagged under Liberia, known as the Eternity C, sank in the Red Sea following an attack executed by Yemen's...

Trump administration restarts Ukraine arms deliveries

WASHINGTON, D.C.: The Trump administration has started sending some weapons to Ukraine again, just a week after the Pentagon told officials...

Sports

SectionPaul Skenes, NL try to end AL's run of dominance in All-Star Game

(Photo credit: Matt Blewett-Imagn Images) ATLANTA -- Just to participate in the Major League Baseball All-Star Game would be a career...

Stokes jokingly reveals Archer watched highlights of Ganguly waving his jersey before delivering sizzling spell against India

London [UK], July 15 (ANI): England Test captain Ben Stokes invoked laughter and revealed that tearaway Jofra Archer watched the highlights...

Mariners C Cal Raleigh will join Team USA in 2026 WBC

(Photo credit: Rick Osentoski-Imagn Images) Seattle Mariners catcher Cal Raleigh is the latest player to commit to suiting up for...

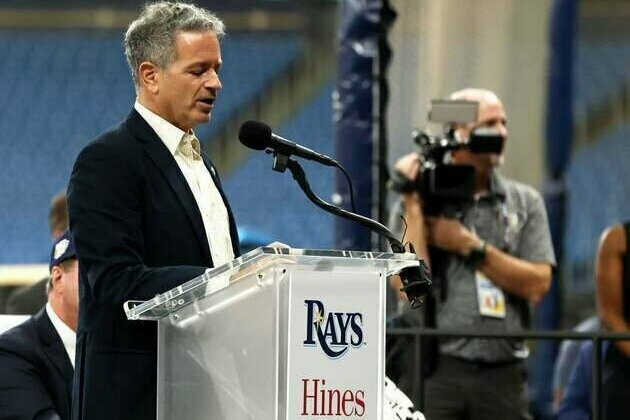

Report: Stu Sternberg agrees to sell Tampa Bay Rays for $1.7 billion

(Photo credit: Kim Klement Neitzel-Imagn Images) Tampa Bay Rays owner Stu Sternberg has agreed in principle to a $1.7 billion deal...

So near, yet so far; Test to be won: Cricket fraternity reacts to India's failed heist at Lord's

London [UK], July 15 (ANI): 'Master Blaster' Sachin Tendulkar and several former cricketers hailed the troika of Ravindra Jadeja, Mohammed...

Yankees claim RHP Rico Garcia off waivers from Mets

(Photo credit: Jay Biggerstaff-Imagn Images) The New York Yankees claimed right-hander Rico Garcia off waivers from the crosstown...